THE COST OF COMFORT

The 2025 PGA Tour season wrapped up this past weekend with a great redemption story after Tommy Fleetwood won the Tour Championship at East Lake in Atlanta. The win was his first since joining the Tour eight years ago, netting him the biggest payday of his career ($10 million).

The weekend also marked the end of LIV Golf’s season, nearly four years after the Saudis launched the new tour and poached a number of the PGA’s biggest stars.

This begs a question — while players like Fleetwood who chose to stay with the PGA Tour have continued to thrive, how have the players who made the jump to LIV fared?

Using major championships as the barometer of success, the answer is — underwhelming at best. As a result, LIV Golf has become a case study in what happens when someone earns life-changing money for simply showing up. The lessons reach far beyond golf.

Launched in 2021 to diversify Saudi Arabia’s oil-dependent economy and enhance its global image, LIV Golf skipped the organic slow-build process, choosing instead to buy immediate relevance by offering massive, guaranteed contracts to top PGA players:

In doing so, LIV upended professional golf’s incentive structure.

How so?

Because on the PGA Tour, pay depends on performance — to finish “in the money,” you must at minimum make the cut. Meanwhile, on the LIV Tour, contracts are guaranteed no matter where you finish.

So, the logical question is — what impact did this new incentive structure have on performance?

THE PERFORMANCE PARADOX

While there are a few exceptions (notably Bryson DeChambeau and Jon Rahm), most players’ performance has deteriorated. Consider two of the biggest former stars on the PGA Tour in the years prior to and after defecting to LIV:

Dustin Johnson — Prior to leaving the PGA, Johnson was ranked #2 in the world, had four top-10 finishes in majors (including two top three finishes) and a Masters victory in 2020. Since joining LIV, he has missed the cut in five of the last eight majors. He currently ranks #120 in the world according to The Data Golf Rankings.

Cameron Smith — Smith was also ranked #2 in the world, had six top-10 finishes in majors and a victory at the 2022 British Open at St. Andrews. Since then, Smith has missed the cut at four of the last eight majors. Currently ranked #92 in the world.

Most recently, just six of the fourteen LIV players who played in the 2025 U.S. Open at Oakmont made the cut, and those that did were irrelevant come Sunday’s final round.

So, what explains the drop?

Some point to LIV’s softer competitive format, smaller crowds, and global travel demands. But the simpler answer lies in human nature — sudden and guaranteed wealth can reduce your drive and motivation, making you too comfortable and complacent in the process.

But, do you blame them?

Be honest…if someone handed you $100 million tomorrow just to show up, would you still grind on the range until sundown, chip until your hands blister, and live out of a suitcase half the year?

Probably not.

INITIAL CONCLUSION

Given this data, I initially concluded that receiving guaranteed life-changing money must make it very difficult to stay motivated. To maintain your discipline. To grind. As a result, it shouldn’t come as a surprise that performance would suffer. However, needing confirmation, I looked at a few other sports. What I discovered surprised me.

I first searched for:

“Worst contracts in team sports history”

This produced lists that largely consisted of players who disappointed due to injuries, rather than a lack of effort — players like Mike Trout in the MLB, Deshaun Watson in the NFL, Rick DiPietro in the NHL, and Allan Houston in the NBA.

I was a bit surprised, so I subsequently searched for:

“Highest current guaranteed contracts in team sports”

Answers included players like Josh Allen in the NFL, Steph Curry in the NBA, and Bryce Harper in the MLB, who are all still playing at an elite level.

My original thesis appeared to be incorrect, or at least flawed, which begged another question — why have guaranteed contracts had a much different impact on these athletes than on LIV golfers?

I concluded it likely boils down to accountability.

In team sports, players are accountable to their teammates and coaches. They must face them daily in the locker room, clubhouse, or huddle. Their success, or lack thereof, has a direct impact on other people’s performance, and therefore their lives. Meanwhile in golf, players only have to answer to themselves.

The result?

Without a level of responsibility to others, complacency tends to creep in more quickly.

SO WHAT?

This dynamic applies far beyond sports. In fact, we are witnessing something similar in financial markets and the implications could be material.

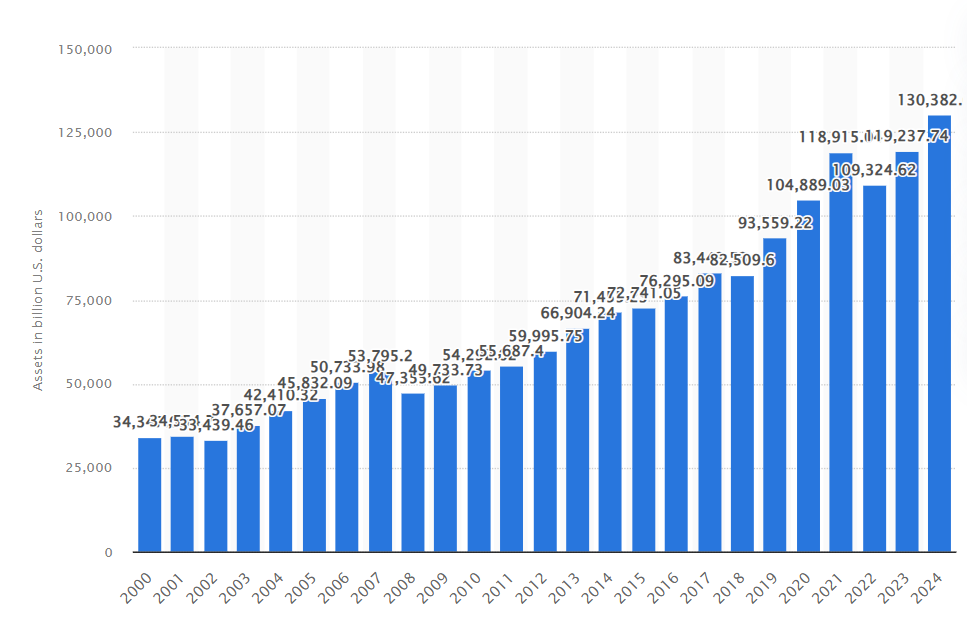

The fact is, a sustained bull market for close to fifteen years in countless assets has potentially made many investors and companies a bit too comfortable. From equities (both public and private) to housing, precious metals, private credit, high yield bonds, and cryptocurrencies, anything with a “risk premium” has appreciated materially. The result is a massive increase is total financial assets across both individuals and institutions alike.

Total Financial Assets — Households and Non-Profits (Statista)

At the same time, the unemployment rate has remained low, credit spreads are still tight, and profit margins have remained elevated.

So, where does this leave us?

In a situation where it will pay to not get too comfortable. To take a team player mentality. To be like Josh Allen and Steph Curry instead of Dustin Johnson and Cam Smith. To strongly consider who is depending on you and the portfolio (or business) you manage, be it your firm, clients, colleagues, investors, partners, or family.

This means realizing that your portfolio’s (or business’s) success has likely benefitted from a very strong tailwind, but is now vulnerable and full of gains that could evaporate in the blink of an eye. Rebalancing and a thoughtful reallocation to assets (or parts of the business) that are cheaper, less risky, and/or out of favor may be prudent at this time.

When it comes to the companies or funds you invest in, look for those with strong cultures, widely dispersed equity, and a demonstrated history of navigating through cycles. Those with leaders who have faced their employees during difficult moments and led them to the other side. Leaders like J.P. Morgan CEO, Jamie Dimon, who navigated his firm through the financial crisis better than anyone and explained part of the reason why, saying,

“Our clients know that we are there for them, are steady, do a good job for them, and that we earn a fair share for ourselves for doing so, which is critical.”

The fact is, a strong economy and market is a great thing. Something we should all be thankful for because it almost always leads to things like higher standards of living and GDP per capita. This said, like a pendulum, the behavior associated with a bull market can swing too far. As a result, those who benefit the most can wrongly attribute this success to skill rather than luck. In doing so, when markets eventually crack, like Dustin Johnson’s world ranking, a portfolio’s value can drop materially in a relatively short period of time.

The fact is, today, institutional portfolios are loaded with equities (both public and private) and 401k participation has never been higher, leading to more than 65% of Americans have some exposure to U.S. equities. This has led to a material rise in private equity valuations and an S&P 500 that currently stands at 23x price-to-earnings. The trouble is that over the past century, any dollars invested at these levels have produced near-zero returns over the subsequent decade (ranges from -2% to 2% annually).

The ironic part about investing is that the times that feel the best are often when portfolios are most vulnerable — while the moments that feel the worst are actually when they are most secure. Said another way, don’t get too comfortable right now. Unlike the LIV Golfers, nothing is guaranteed.

S&P 500 Price/Earnings Ratio (100 Years)