미국 외 최대 기업들, 중국이 지배

국가 별로 보면 중국이 상위 50개 중 12개를 차지하며 가장 많은 기업을 보유하고 있습니다

인터넷 대기업 TENCENT와 전자상 거래 거인 ALIBABA가 대표적이며 이들 기업은 기술 그룹 입니다

또한, 중국의 'BIG FOUR' 은행들이 합쳐서 거의 1.2조 달러의 시장 가치를 더 하고 있습니다

증류수 제조사인 '귀주 마오타이'도 2,500달러의 벨류에시션으로 중국 산업의 폭넓은 영향력을 보여줍니다. 홍콩에 상장된 차이나 모바일을 합하면, 이 지역의 기업 수는 13개로 늘어납니다

이것은 중국 자본 시장이 국내 성장 둔화와 무역 마찰에도 불구하고 계속해서 심화하고 있음을 보여줍니다

Ranked: The 50 Largest Companies Outside the U.S., in 2025

Published

2 days agoon

August 7, 2025By

Pallavi RaoGraphics/Design:

![]() See this visualization first on the Voronoi app.

See this visualization first on the Voronoi app.

Ranked: The 50 Largest Companies Outside the U.S.

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

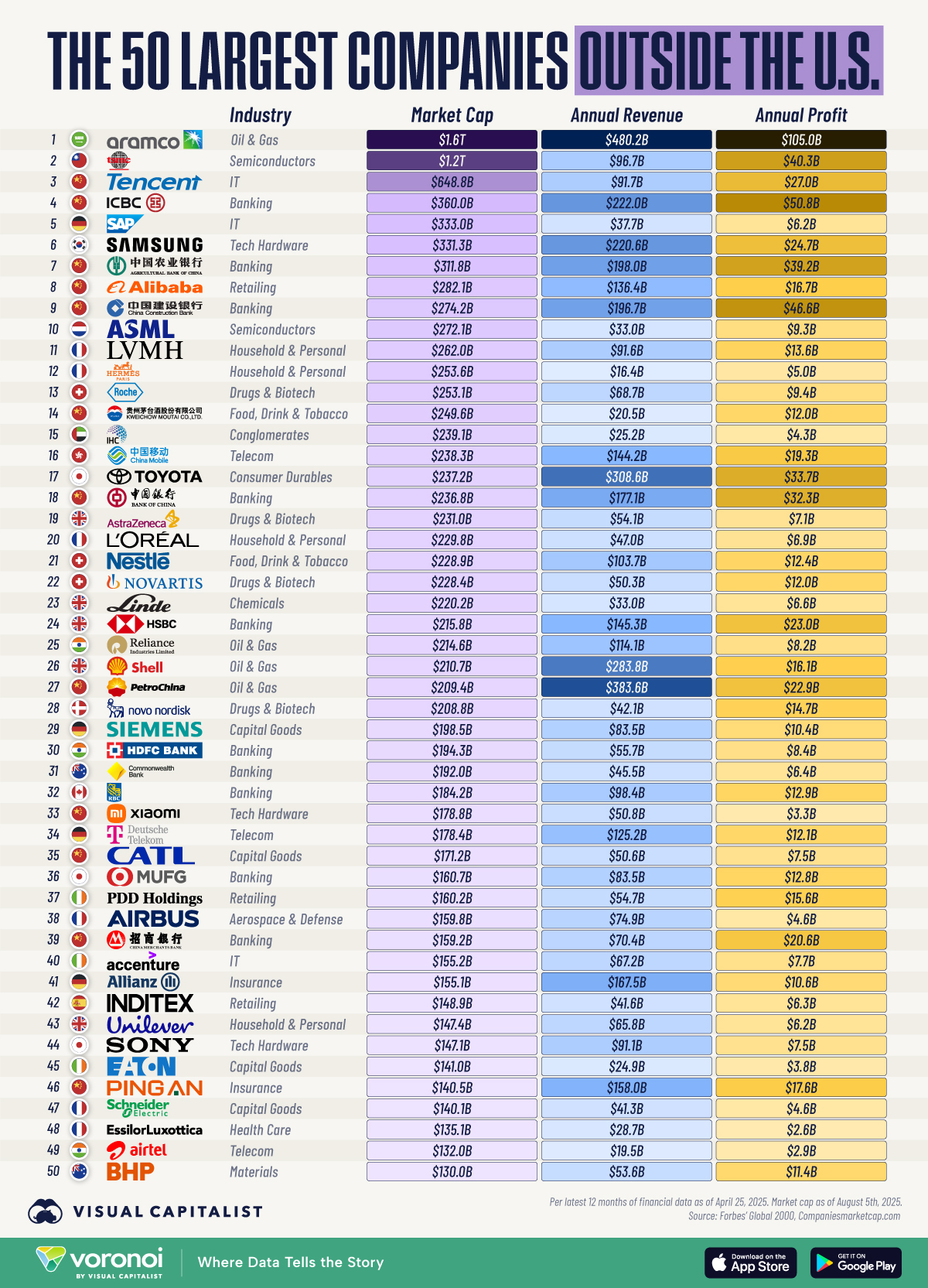

- China leads the most valuable companies outside the U.S. with 12 in the top 50 (13 if counting China Mobile in Hong Kong).

- Luxury and tech firms earn premium valuations for their sales, while resource giants lag despite massive revenues.

- Europe thrives in brand-driven sectors like luxury and pharma, while Asia drives innovation in tech hardware.

From oil behemoths to chip-making titans, the corporate world beyond America is vast and varied.

This ranking spotlights the 50 largest public companies headquartered outside the United States, measured by market capitalization, profit, and revenue.

Annual revenue and profit data for this visualization comes from Forbes Global 2000, which looks at 12- month preceding metrics as of April, 2025.

Market capitalization figures are sourced from Companiesmarketcap.com, as of August 05th, 2025.

Largest Companies Outside the U.S.

Saudi Aramco is the most valuable company outside the U.S., commanding a $1.6 trillion market capitalization.

The valuation is well-deserved, considering Saudi Aramco also pulled in the highest annual revenue ($480 billion) and profit ($105 billion) on this list.

| Rank | Company | Industry | Market Cap | Annual Revenue | Annual Profit |

|---|

| 1 | 🇸🇦Saudi Aramco | Oil & Gas | $1.6T | $480.2B | $105.0B |

| 2 | 🇹🇼TSMC | Semiconductors | $1.2T | $96.7B | $40.3B |

| 3 | 🇨🇳Tencent | IT | $648.8B | $91.7B | $27.0B |

| 4 | 🇨🇳ICBC | Banking | $360.0B | $222.0B | $50.8B |

| 5 | 🇩🇪SAP | IT | $333.0B | $37.7B | $6.2B |

| 6 | 🇰🇷Samsung Electronics | Tech Hardware | $331.3B | $220.6B | $24.7B |

| 7 | 🇨🇳Agricultural Bank of China | Banking | $311.8B | $198.0B | $39.2B |

| 8 | 🇨🇳Alibaba Group | Retailing | $282.1B | $136.4B | $16.7B |

| 9 | 🇨🇳China Construction Bank | Banking | $274.2B | $196.7B | $46.6B |

| 10 | 🇳🇱ASML | Semiconductors | $272.1B | $33.0B | $9.3B |

Note: Industry classifications as per Forbes data.

TSMC is the only other non-U.S. company with a trillion dollar valuation ($1.2 trillion).

More on TSMC, and valuations, in the last section.

China Dominates in Largest Companies Outside the U.S.

From a country perspective, China is headquarters to 12 companies in the top 50, more than any other country on the list.

Internet conglomerate Tencent and e-commerce giant Alibaba headline a tech-heavy cohort. Meanwhile, the nation’s “Big Four” banks together add almost $1.2 trillion in market value.

Even distilled-liquor maker Kweichow Moutai cracks the global elite with a $250 billion valuation, underscoring the breadth of China’s industrial reach.

If we count Hong Kong–listed China Mobile, the region’s tally rises to 13.

This is evidence that Chinese capital markets continue to deepen despite slowing domestic growth and lingering trade friction.

Luxury Labels and Chipmakers Command Premiums

Outside China, two groups stand out for sky-high price-to-sales multiples: European luxury houses and East Asian semiconductor firms.

For example, France’s Hermès trades at more than 50x its earnings, driven by affluent consumers and tight brand control.

Meanwhile, Taiwan’s TSMC and the Netherlands’ ASML dominate the global chip supply chain.

As a result, investors reward their near-monopoly positions with valuations topping 30x annual earnings.

Resource Giants Earn Less Love from Investors

Aside from Saudi Aramco, there are a number of resource companies on this list including: Shell, PetroChina, Reliance Industries, and BHP.

Yet the average price to earnings ratio for this entire group is 15x, half of what investors are willing to pay for TSMC and ASML.

Heavy cyclicality, decarbonization headwinds, and shareholder fears of “stranded assets” keep energy and mining names trading at steep discounts to consumer and tech peers.

댓글 없음:

댓글 쓰기